|

|

|||

|

|

|

|

|

|

|

|||

|

|

|

|

|

Experiencing Objectivism through Quicken Appendix C Experiencing Objectivism through Quicken® Introduction The field of economics studies the production, distribution, and consumption of material values. While socialism assigns the task of such management to the central government, capitalism leaves it ultimately to the individual. In other words, pure socialism fully renounces the idea of individual private property rights while pure capitalism fully embraces it. It follows logically that pure socialism will attempt to produce, distribute, and consume material values based on the spiritual values of those with political power. By contrast, pure capitalism will attempt to produce, distribute, and consume material values based on the spiritual values of those with economic power. While political power flows from force, economic power flows from mind. While socialism attempts to use force to engage in collectively centralized economic planning, capitalism attempts to use mind to engage in individually decentralized economic planning. While socialism rewards those who usurp political power, capitalism rewards those who earn economic power. A cursory look at history will show readily that capitalism succeeds at achieving wide scale material abundance while socialism fails miserably at it. Every undertaking throughout history in full scale, collectivized, forced economic planning of the production, distribution and consumption of material values has resulted in rampant scarcity, starvation, suffering, and death. Whether one looks at the former Soviet Union or modern North Korea, one sees the stark contrast of the average citizen's financial suffering against those of his counterparts in capitalistic societies such as the United States of America. Sadly, even primarily capitalistic nations like America suffer from socialized institutions that suppress mind, the source of economic power. Government schools in capitalistic nations neglect to teach students how to think like capitalists. As a result, most students graduate high school or even college utterly clueless about how to manage their own personal economics, i.e. the production, distribution, and consumption of the material values they need to live well as individuals. This appendix seeks to accelerate the reader up to speed on this most crucial aspect of living well in a free society. The author hopes eventually to see it expanded into two subsequent books called The Vision-Driven™ Producer and The Vision-Driven™ Investor. For now, this appendix will have to suffice. Spiritual Basis of Economic Values The philosophy of Objectivism holds the Self as the ultimate value and reality as the ultimate standard by which to judge all things -- ideas, events, people, investments, etc. -- as good or bad for the Self over a lifetime. It recognizes that each human being has both a material and spiritual element, i.e. a body and a soul indivisible, and that free will leaves an individual at liberty to think or not. Such an integrated nature demands that one adopt a fully secular yet spiritual set of cardinal values to guide him:

Chapter 12 of this book outlined eight fundamental roles that any person in a free society may fill in accordance with his values and abilities to relate to the world for mutual human benefit. Described in alphabetical order, with the most important three highlighted in bold, they are:

Figure 12.1 of Chapter 12 employed the metaphor of a moral compass with reality as the true north, the role of Individual as the aligning role between the ultimate central value of the Self and reality, and all other roles serving the self with Individual as the final decisive role. In other words, all roles that one fills must ultimately hold the Self as the ultimate central value, reality as the ultimate orientation reference, and the role of the Individual as the proper beneficiary of all those other roles. Quite suitably, the two roles that provide the material values to the Individual to sustain and advance his own life and make all his other values possible, Producer and Investor, occupy places adjacent to Individual and closest to the "true north" orientation of the moral compass. The remaining roles remain necessarily subservient to these three key roles on the moral compass.  Figure 12.1 The Vision-Driven™ Life Moral Compass A free society leaves the Self at liberty to fill these roles in accordance with his own best judgment so as to maximize his long term joy and minimize his long term suffering. Consciously chosen forms of joy amount to ways of loving one's own life. As a social animal, a human being generally finds that loving others can greatly enhance his love of his own life. Thus, as described earlier in this book, one can analyze the cardinal value of self-esteem or love of self and break it into five component forms of love as listed alphabetically here with the most important one in bold:

Spiritual Economic Management This groundwork brings this appendix finally to its main subject, namely that of personal financial management. The age of the computer and the Internet has made the task of home economics easier than ever. Sadly, the confusing barrage of messages and propaganda from all sides combined with the slipshod education most receive leave the individual quite helpless in many ways to manage his finances well. Most have only a vague and foggy vision of what they want and how they intend to achieve it, especially with respect to the financial aspects of that vision. Most financial instructors themselves do not account for the deep, spiritual aspects of economics. Often they remain locked into mundane aspects of how to save for the college education of children, for instance, without answering the "big questions" of whether one ought to have children in the first place. Even past gurus like Charles Givens, who did address the issue of personal values in financial planning, never went beyond a superficial mention of these values to suggest how to evaluate their deeper merits. Worse, in general, they tend to avoid the "nuts and bolts" of cash flow management and integration and instead rely on disintegrated case study examples. All these shortcomings leave the poor reader groping for ways to assemble this scattered information into a coherent, useful system he can grasp as a unified, self-centered, reality-oriented whole. Happily, more and more people have begun to liberate themselves from the drudgery of paper-based bookkeeping with powerful financial packages such as Quicken® by Intuit. Breaking free from such tedium leaves the individual more time and energy to step back, relax, take a deep breath and oversee the "big picture" or vision of how his life might be and ought to be. Doing this effectively requires integrating key aspects of this book into the software. Fortunately, the reader needs no special skills to make this happen. A simple commitment to purchasing and familiarizing oneself with Quicken or some other common financial planning package will suffice. This appendix will use Quicken 2005 Premier Home & Business to illustrate such integration. It does not aim to tutor the reader on how to use the software, but rather shows the reader who has familiarized himself with that software how he can integrate the key concepts of this book into that package. Vision-Driven™ Economics Traditional templates for financial planning generally include mundane categories such as

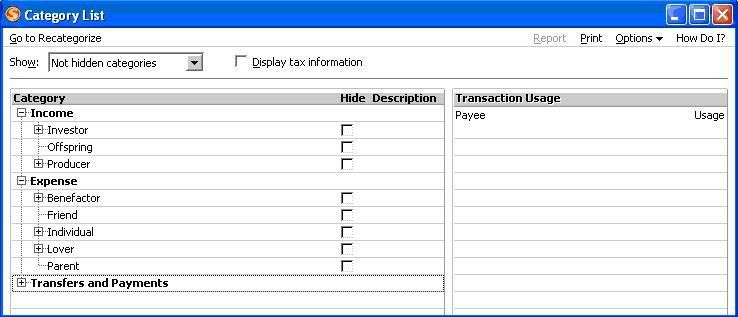

Follow the Cash Flow Anyone who has had any experience with money understands the basic fact that an Individual can only spend as much money as he has in his possession. Whether he obtains that money by earning it, borrowing it, inheriting it, mooching it, or looting it, he can only purchase things he desires with money he has on hand. An honest person will confine himself to earning, borrowing, or inheriting money that he intends to spend with the caveat that he actually intends to pay back the money he borrows at the agreed terms. So the basics of cash flow involve both incomes and expenses. Positive cash flow results from incomes that exceed expenses over time. Quicken allows the user to categorize incomes and expenses. Integrating that tool with the eight fundamental roles results in the following figure:  Figure C.1 The Vision-Driven™ Life Quicken Categories As this figure shows, you can generate your initial cash flow stream from any of several sources. You can possibly rearrange these so that some roles generate incomes rather than expenses. However, such inversions typically represent financially abusive relationships and so fall outside the focus of this appendix on loving life and respecting the rights of others to live free of your mooching. Thus, this appendix will avoid those examples. You should also make clear to yourself that this figure assumes that you, as an Offspring, honorably deserve any inheritance your elders may leave you and should not rely on them to support you for the rest of your life. Each of these eight major categories allows you to create subcategories to account for specific types of expenditures. For instance, you can create subcategories for groceries under each role that consumes them such as Individual, Lover, and Parent. When entering transactions for a visit to your local grocery store, you can create split transactions that let you divide these costs among those roles seamlessly and elegantly. Through the power of online banking, you can download these transactions automatically on a daily basis and keep track of how you gain and keep your values financially with very little editing required on your part. Rational Expenditures Whether you earn income as an employee or a business owner, a Producer or an Investor, or some combination of all of these, you will ultimately aim to spend that income to achieve your various forms of loving life. As Charles Givens notes in More Wealth without Risk, you can only spend income on three types of purchases:

To become totally clear on how you spend your money on loving your life via your roles, you need to categorize your various incomes and expenses in terms of those roles as explained earlier in this appendix. This will help you to ascertain whether you spend too much, too little or just the right amount on each way you have of loving your life. Once you begin to see how your cash flows from production through distribution to consumption, you can determine whether you need to make changes to bring yourself a greater sense of balance and inner peace. Experiencing Economic Essentials Growing your net worth over time requires focusing on maximizing spending income on appreciables while minimizing spending income on depreciables and consumables. Quicken allows you an instant "snapshot" of your financial health in terms of net worth, cash flow statements, and so forth. All these tools need to serve the ultimate purpose of maximizing your enjoyment of life rather than forcing you to work slavishly for a large bottom line you will never live to enjoy. So getting totally clear on your emotional values and the roles you want to fill becomes paramount in making this financial management process work for you rather than against you. This means getting back to the basic definition of economics as a science for examining the production, distribution, and consumption of material values. Production Most people generate personal income as an employee of someone else. Others own their own businesses. Still others, especially retirees, have income-generating assets such as large mutual fund holdings to generate adequate personal income. Others still have the fortune of trust funds from ancestors that continue to generate income streams sufficient to live well. All these various forms of material productiveness have their corresponding roles as Producer, Investor, or Offspring and warrant corresponding categorization as such in Quicken. You should also note that if you did not directly produce that income through your own role as a Producer that it resulted instead from the productive efforts of others leveraged through your role as an Investor or an Offspring. All wealth results ultimately from the virtue of productiveness, i.e. the reshaping of the earth into the image of human values. Even "investing" in a winning lottery ticket only yields wealth to you because of the productive efforts of others who "invested" in the losing lottery tickets. Distribution The mindset of the Individual making the decisions about how to distribute these income streams of his various roles will dictate over time his results of abundance or scarcity, wealth or poverty. A productive mindset will lead to a continuous nurturing of his role as an Investor via his steadily ongoing purchases of productive assets such as growth stock mutual funds, etc. It will also lead him to a continuous nurturing of his role as a Producer via his steadily ongoing purchases of continuing education, business assets, etc. While some mistakenly call these expenditures "sacrifice" they actually amount to investiture in the future of the self over his expected lifetime. His expenditures now assure a life well lived in the future. By contrast, a purely consumptive mindset leads to a complete abandonment of any focus on the future in favor of immediate gratification. He will consume conspicuously on himself through the purchase of costly vacations, dinners, and other consumables for the sake of the present moment. He may even consume conspicuously in the name of "love of others" by spending lavishly on his spouse, children, parents, and so forth -- even "charitable causes." In the end, however, he and his loved ones suffer as the cash flow and even the assets that generate it vanish into thin air. Learning how to manage the distribution aspect of your personal finances becomes just as important as learning how to produce the income stream in the first place. Some people manage to generate huge sums of personal income yet their net worth remains less than zero due to excessive consumption. Some even manage to destroy themselves with their excesses as weekly headlines from Hollywood demonstrate. By contrast, seemingly poor people with low incomes manage to raise several children into fully functioning adults while living to a ripe old age without falling into traps of abject poverty and homelessness. Why? The answer comes down to free will and values. Those with a hard orientation to reality, including the necessity of thinking long range, understand that, for instance, a farmer cannot eat all his seed corn and expect to plant and harvest a corn crop next year. He must necessarily set aside a portion of this year's harvest to plant next year. Moreover, he cannot "just for kicks" set his barn afire for the sake of one night's entertainment. He has the freedom at any moment to focus on these facts or to evade them. However, he does not have the freedom to evade the consequences of these actions. While farming represents a hard life, it has the merit of a full grounding to reality and bestows upon the farmer a firm grasp of the economic cycle of production, distribution and consumption. Those who acquire wealth through inheritance or lottery winnings do not always enjoy this firm grasp and thus frequently see that wealth vanish as easily as it appeared. Sadly, such a weak grasp of the facts often leads to a life misspent on counterproductive activities that lead to suffering rather than joy. Newspapers repeatedly tell tales of wealthy heirs and lottery winners who meet bitter ends after years spent in jails and rehabilitation centers. Consumption As a living human being, you must necessarily consume food, clothing, shelter, water, etc. just to live. In addition, you have psychological needs for entertainment, pleasure, and so forth. Together, these manifest themselves as the five forms of love described earlier in this appendix. You experience them through the eight fundamental roles. As examples:

All this time, energy, and expense spent on those roles divert away from those activities that generate the incomes needed to support such roles in the first place. A disruptive child can divert your focus away from that important business meeting that could bring you income for the next three months. An alcoholic spouse can do the same. So can a meddling parent. Such counterproductive people harm not only you, but themselves as well. However, the responsibility for putting them into their place falls ultimately on your shoulders. Having read this book and the related Ayn Rand reading assignments, you should find yourself fully prepared to assert your natural right to life against these assaults and to act accordingly. While capitalism produces the greatest amount of wealth of any system, it still requires that even the wealthiest people dispose of their accumulated assets in a rational manner. Creating a sound estate plan will assure that your wealth continues to support your values long after you have stopped breathing. As the saying goes, "You cannot take it with you." Even the best efforts over a lifetime will not grant you biological immortality. Since your accumulated productive assets may continue to exist long after you return to dust, you must effectively "consume" them out of your own possession through your bestowment as a Parent to your own children, as a Lover to your spouse, or as a Benefactor to your favorite charities. Conclusion This appendix has shown you how to experience capitalistic economics on a micro level. It has shown how to integrate the eight fundamental roles and five fundamental forms of loving life intimately into your economic balance sheets using a widely available and easy to use software package called Quicken. Doing so allows you to step beyond mundane material cash flow tracking to look at the deeper spiritual meaning of making the most of your money. Engaging in this crucial activity seriously on a daily basis will allow you to experience Objectivism and to live a truly Vision-Driven™ Life. Discuss this Article (9 messages) |