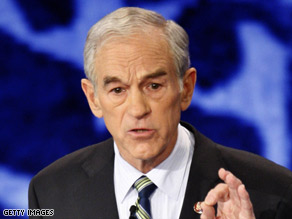

Editor's note: Ron Paul is a Republican congressman from Texas who ran for his party's nomination for president this year. He is a doctor who specializes in obstetrics/gynecology and says he has delivered more than 4,000 babies. He served in Congress in the late 1970s and early 1980s and was elected again to Congress in 1996. Rep. Paul serves on the House Financial Services Committee.

Rep. Ron Paul says the government's solution to the crisis is the same as the cause of it -- too much government.

(CNN) -- Many Americans today are asking themselves how the economy got to be in such a bad spot.

For years they thought the economy was booming, growth was up, job numbers and productivity were increasing. Yet now we find ourselves in what is shaping up to be one of the most severe economic downturns since the Great Depression.

Unfortunately, the government's preferred solution to the crisis is the very thing that got us into this mess in the first place: government intervention.

Ever since the 1930s, the federal government has involved itself deeply in housing policy and developed numerous programs to encourage homebuilding and homeownership.

Government-sponsored enterprises Fannie Mae and Freddie Mac were able to obtain a monopoly position in the mortgage market, especially the mortgage-backed securities market, because of the advantages bestowed upon them by the federal government.

http://www.cnn.com/2008/POLITICS/09/23/paul.bailout/index.html

What I find significant is the fact that CNN presented this at all. It is too easy to complain that "the media" is controlled by your enemies, whoever they are. Ask a serious green and they will tell you that the mass media serve the capitalist ruling class that is polluting the planet. A psychological need is at work when Objectivists and Libertarians complain about the liberal/statist/mystic/whatever bias of the media.